An investor in @JoinMeow, a firm that holds treasuries for its clients, told us that some startup founders are putting money they took out of SVB into Meow. “I've seen [over] $500m flow in so far today. Better Meow and solvent then respectable and insolvent."

Easy. @JoinMeow is a great solution that many of our companies are using.

I’m an investor. Team is great, investor base is Tier 1, and it’s all backed by reputable partners and coverage.

For our corporate treasury, we're using @JoinMeow

I'm an investor & fan of the team and think their nominal fee is 100% worth it

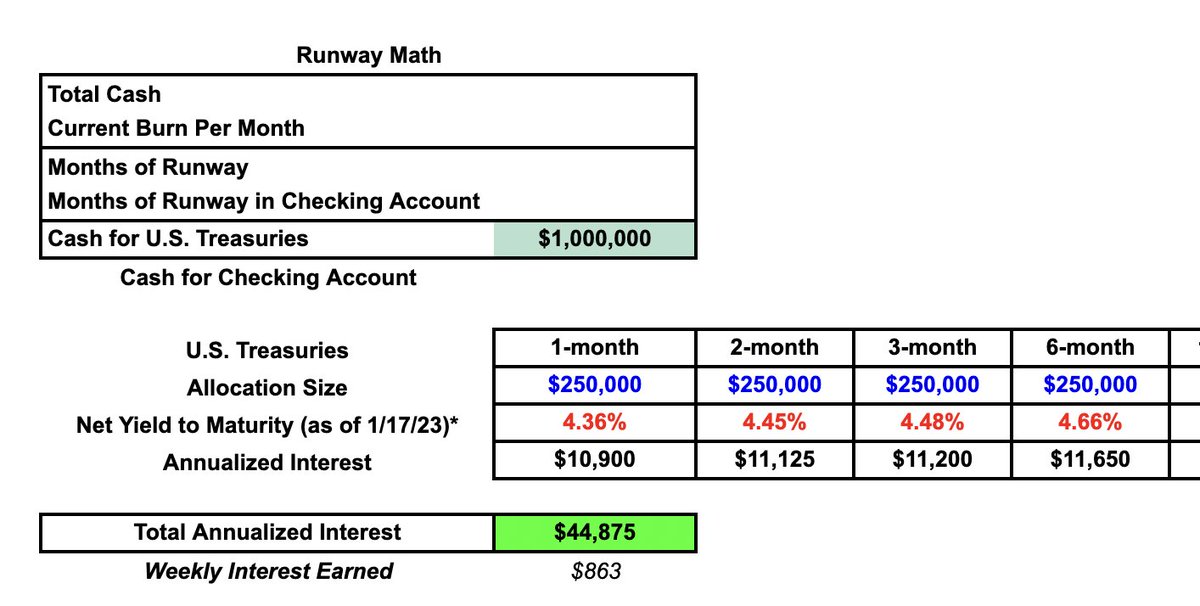

I'd still recommend 6+ months of runway in your bank

But beyond that, if you've raised a lot of money, you're leaving real money on the table

The amazing speed and care that the @JoinMeow and @arvanaghi showed is unreal. More companies should strive for their experience

Your product is a no brainer. Very well done. Insane it’s not a business standard.

Given current interest rates assuming its a thing for biz accounts as well?

Pretty sure the @JoinMeow guys can help you out w this!

@arvanaghi

Interest income will be "first revenue" for a bunch of startup :)

Agree that @JoinMeow is a great option. I've suggested all of our port cos take a look.

A few clicks will generate meaningful extra cash vs standard cash management options.

Not an investor, but am a customer.

Our March newsletter is live.

We go deep on the aftermath of the SVB collapse and share more about the value of partnerships with @AtomicInvest, @treasuryprime and @JoinMeow.

mailchi.mp/0be5ed2fa137/m…]

To receive the newsletter every month, subscribe👇

qedinvestors.us19.list-manage.com/subscribe?u=6b…

Huge - know how much work you put into pulling this off, congrats on making it happen!

Animal Spirits: Startups in a Crisis

theirrelevantinvestor.com/2023/03/27/tal…

Two fer today.

We had @arvanaghi on to talk about how @JoinMeow helps companies manage their cash.

We also had on @DevonDFD to chat about how they're working with asset managers to solve for distribution.

offers an account with T-bills + payments with 4.31% yield. Some people get hung up on the name, but I have a feeling Meow will be a big player.

Their motto is Costco of Financial Services. Feels like a modern day Vanguard with payment rails.

I got no stake in them.

💰Fintechs like @JoinMeow, @NorthOneApp, and @mercury have reported a rush of new clients in the aftermath of SVB’s collapse – and there are a few takeaways for traditional FinServs insightsdistilled.com/march-21/#neob…

Some ideas of how to setup your financial stack post SVB.

linkedin.com/posts/alexroyt…

@mercury @JoinMeow @tryramp