Nitin Basal

Best customer service, hands down. Just fantastic to work with, from start to end, very accommodating with so many changes I requested. Even for the rapid reports attention to the details was clear from the reports. Overall LOVE IT!! I will use them again and will also refer to my friends and clients.

Quynh Ho

Great communication throughout! They made the process pretty simple and they followed through appropriately and the cost seg analysis was completed very quickly! Highly recommend!

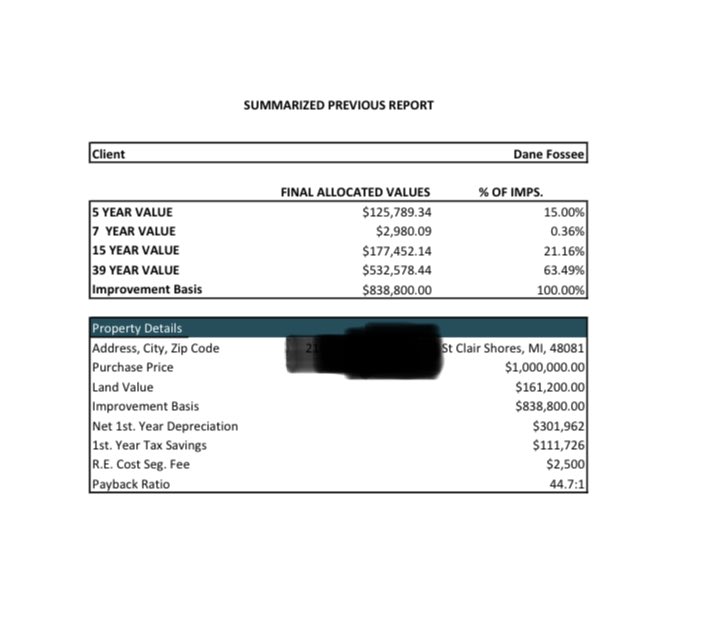

Bought this property September last year.

Did a cost seg study in January

Depreciated $162,000.

Saved $56,000 in taxes this year.

This is the craziest tax strategy.

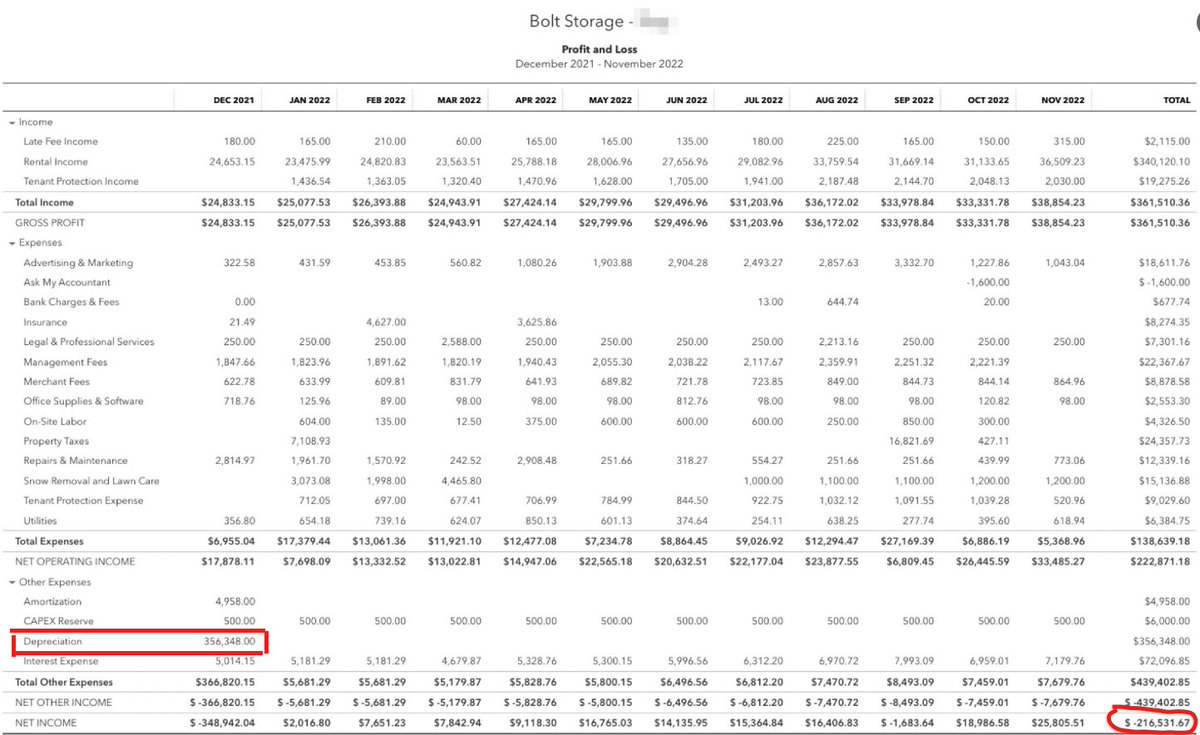

Here are the numbers of how cost segregation saved me 💰

Built an asset for $11,500,000

Depreciated $2,231,000 in our first year

Without cost seg, the 1st year depreciation would have been ~$383,333

That means I have a tax shield (aka I can make without paying taxes on)…

Used @recostseg today. It’s not my first cost seg, but it was definitely the easiest. Kudos @sweatystartup and @baldridgecpa

Just wrapped up my first cost segregation on a build to rent duplex with @recostseg

Super easy we just did a virtual walk through and I sent them our construction budget

First year payback ratio is 14:1

(tax savings / cost to do the study)

Thanks RE Cost Seg for saving me lots of money this year (and next..)

Well ran, clean reports, fair prices

Just did my first virtual inspection with @recostseg this morning. Simple, convenient and unlike the other service I tried that did no such inspection or survey, I’m confident it will actually be accurate.

Just got 2 reports from @recostseg 4 more to go, if you have not reached out to there team you are missing out!!!

Also a big thank you to @recostseg for the big Christmas gift on the tax return last year.

A depreciation deduction nearly equal to our cash contribution!

Just got the cost segs back @recostseg

10/10 recommend

Paying zero taxes on our real estate profits and partner & I each are receiving a $25k deduction against our W2 earnings. Excess losses carrying forward to 2023 as well.

Not today, Uncle Sam!

Solid work by @recostseg !

The power of Twitter 💥 - was impressed with @baldridgecpa on @fortworthchris podcast. Later discovered he and @sweatystartup own this co …gave them a shot. Highly recommend.

did my report this year and it’s a much better process than what I’ve used in the past. Highly recommend

Bought this property September last year.

Did a cost seg study in January

Depreciated $162,000.

Saved $56,000 in taxes this year.

This is the craziest tax strategy.